The objectives

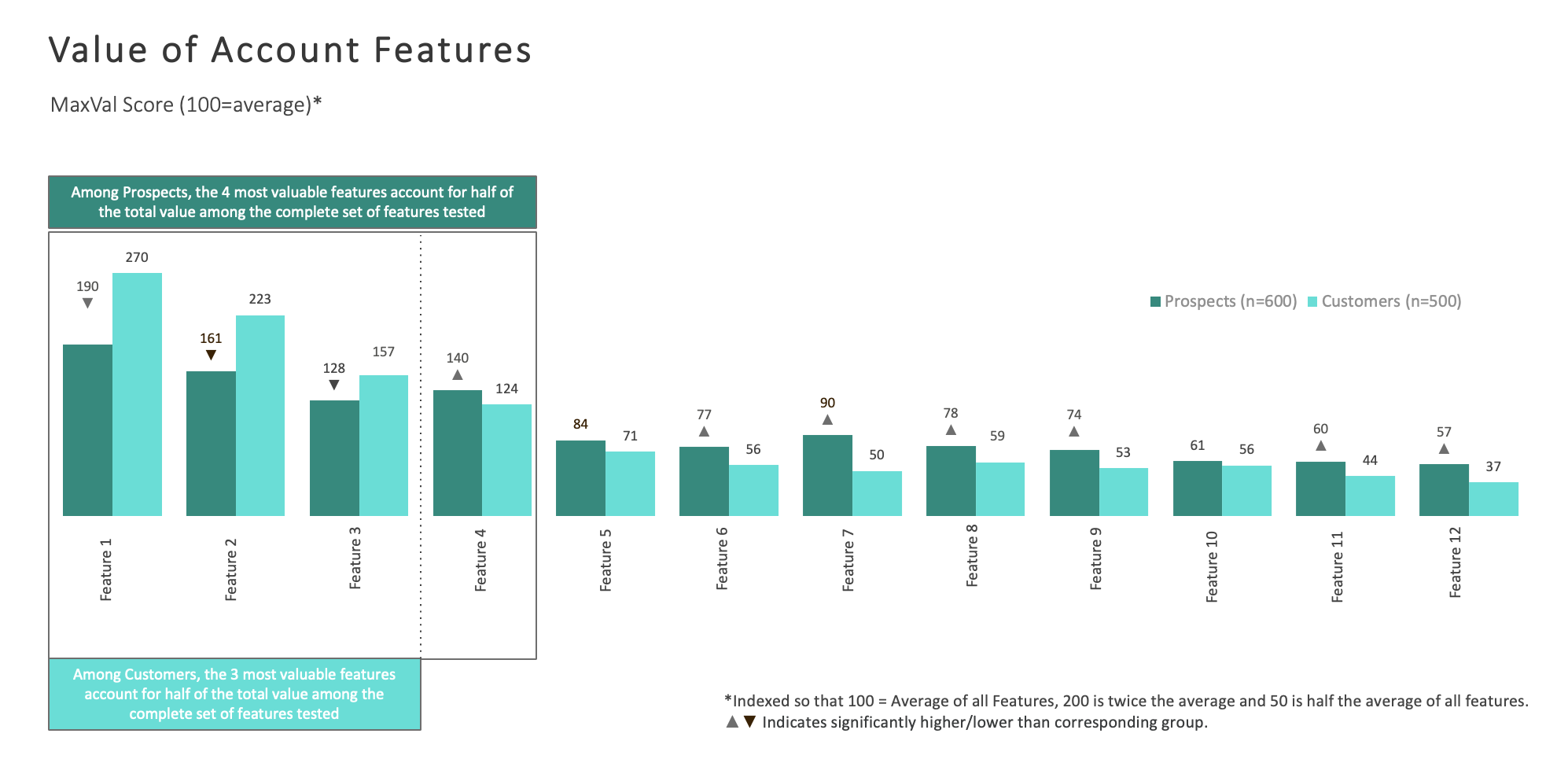

A financial services client wanted to revamp its checking account portfolio, replacing its current products with new, more innovative offerings that would help it expand its customer base. The client was considering 12 account features and needed to identify and quantify which were most valuable to consumers to prioritize those features in new product development efforts. Our client wanted to maximize its potential to attract new business but also needed to ensure that the new products appealed to existing customers, especially current high-value customers.

our approach

To provide direction on product design, Illuminas used its MaxVal™ solution to determine the value consumers place on each of the 12 potential checking account features as well as the value of those features relative to each other. Compared to other methods often used to measure value or importance, such as rating scales or ranking exercises, MaxVal™ identifies the precise value of different features, and these values can be compared and traded-off against each other to identify a prioritized list.

MaxVal™ also has several advantages over another frequently used approach, MaxDiff scaling. Unlike MaxDiff, MaxVal™ does not consume a lot of space on a questionnaire, which reduces respondent burden when evaluating a large number of features providing higher quality data. The approach also leaves room to address other client objectives in the same questionnaire and allows for richer product or feature descriptions than MaxDiff. This was useful in this study because some account features required a sentence or two to describe them clearly.

Illuminas used a proprietary algorithm to calculate the MaxVal™ scores and then standardizes those scores so that a score of 100 is equivalent to the average across all account features tested; a score of less than 100 means the feature is less than average value, while a score above 100 means the feature is more than average value. The calculations have a level of precision that allows comparison based on order of magnitude. Further, a group of features can be added to determine the total percent of potential value accounted for out of the set of all features. See the example below for how results are reported and interpreted:

the outcome

The action-oriented output of MaxVal™ provided precise, clear direction to guide product development. The financial institution gained valuable insights to identify the account features that were most valuable to prospective and existing customers, ensuring the new products would appeal to both audiences and contribute to a successful product launch.