The objectives

One of the nation’s largest credit unions with over 300 branches needed a system to monitor the member experience across the organization. Branch managers, as well as regional and senior management, desired real-time metrics to assess the member experience at individual branches to more effectively manage the business. This real-time system would allow management to identify issues, respond to members in the event of a service failure, and assess the effectiveness of service improvements quickly.

our approach

Illuminas designed a member experience measurement system to assess member satisfaction with branch transactions within 24-48 hours of the transaction. The system automatically sends a survey invitation to members after they complete a transaction inviting them to take a brief 5-7 minute survey about their experience. The system includes an alert system for branch managers to notify them of service failures that require follow-up based on members’ survey responses.

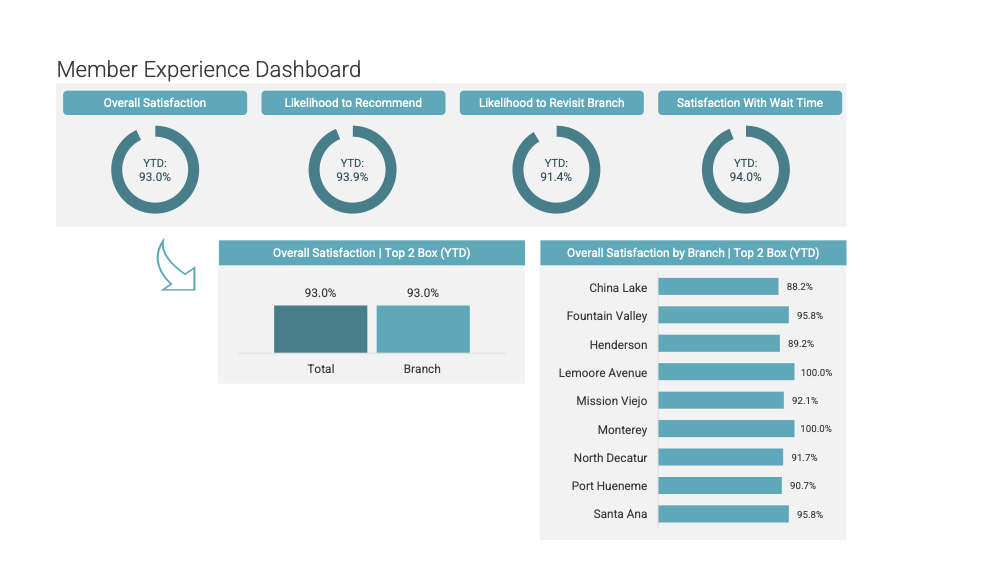

At the heart of the solution is a real-time interactive dashboard that includes key metrics important to the organization, trending over time, and graphics for easy-to-understand data visualization. The dashboard also provides access to insights by title/responsibility. Branch managers are able to monitor their branch’s performance and follow-up with their own members if there is an issue. Regional managers and senior executives have access to a broader view of the regions, as well as an organization-wide view for strategic decision making. The system also includes an instant-analytics portal for the member research and branch operations teams to answer top-of-mind questions quickly from the data.

Illuminas provides a quarterly report to the credit union that provides deeper analysis designed to uncover insights and opportunities for the organization to improve their members’ experiences.

the outcome

The credit union is planning to expand the program to include call center transactions, lending, and mortgages, much like Illuminas does for other credit union clients. This holistic system will provide the information the credit union needs to increase overall member loyalty.